Finance

Projects

American Option & Longstaff–Schwartz

17 Sep 2025 by Tom Gilgenkrantz

- Simulation of geometric Brownian motion paths

- Estimation of continuation values using linear regression

- Detection and visualization of early exercise points and the exercise boundary

- Pricing of the American option using the estimated continuation values and early exercise points

Option Pricing Dashboard

5 Sep 2025 by Tom Gilgenkrantz

- Interactive Plotly dashboard to explore Call/Put pricing sensitivities

- Grid of effects of S, K, T, r, σ

- Greeks bar chart

- Dynamic KPIs: price, intrinsic, time value, moneyness, break-even, max loss/profit

Convertible Bond Pricer

26 Aug 2025 by Tom Gilgenkrantz

- Implementation of a closed-form Black–Scholes model for convertible bond pricing

- Derivation of sensitivities to volatility, interest rates, dividends, and stock price

- Visualization of the payoff structure (bond floor + conversion option)

- Monte Carlo simulation of stock price trajectories to analyze risk distribution

Millennium Market Making Challenge

23 Jul 2025 by Tom Gilgenkrantz

- Python implementation of a automated Market Maker within Amplify’s Quant Trading simulator in 24 hours

- Object-oriented design of a quoting engine returning two-sided bid/ask quotes

- Backtest of synthetic ETF vs. real FAANG benchmark with normalization for comparability

- Implementation of a systematic trading strategy based on spread between FAANG ETF and its components

- Live exposure & PnL monitoring of the trading strategy

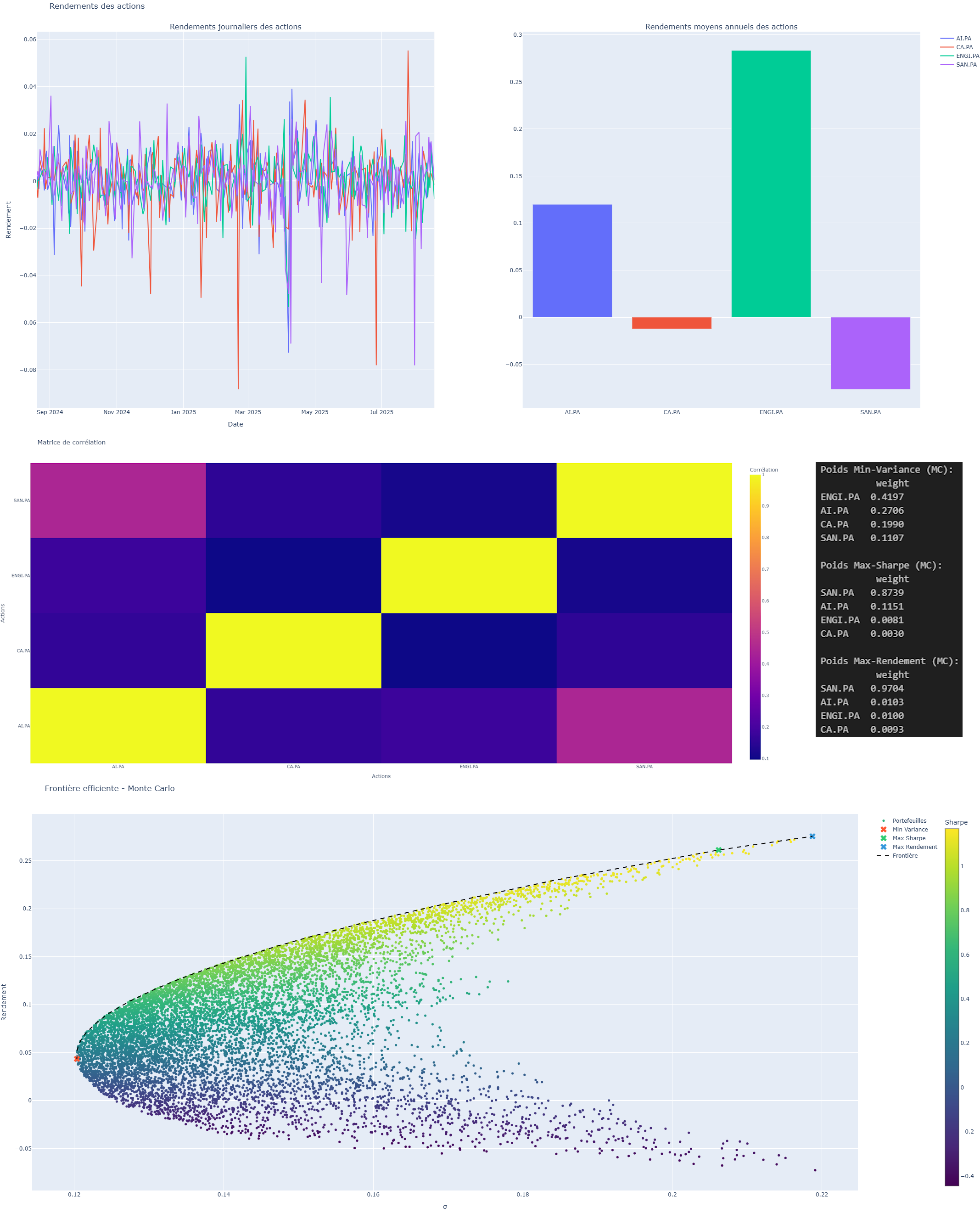

Markowitz Portfolio Optimization

18 May 2025 by Tom Gilgenkrantz

- Implementation of the Markowitz mean-variance portfolio theory

- Construction of the efficient frontier with Monte Carlo simulations

- Estimation of covariance matrix and expected returns from historical data (Yfinance)

- Visualization of efficient frontier, minimum variance portfolio and tangency portfolio

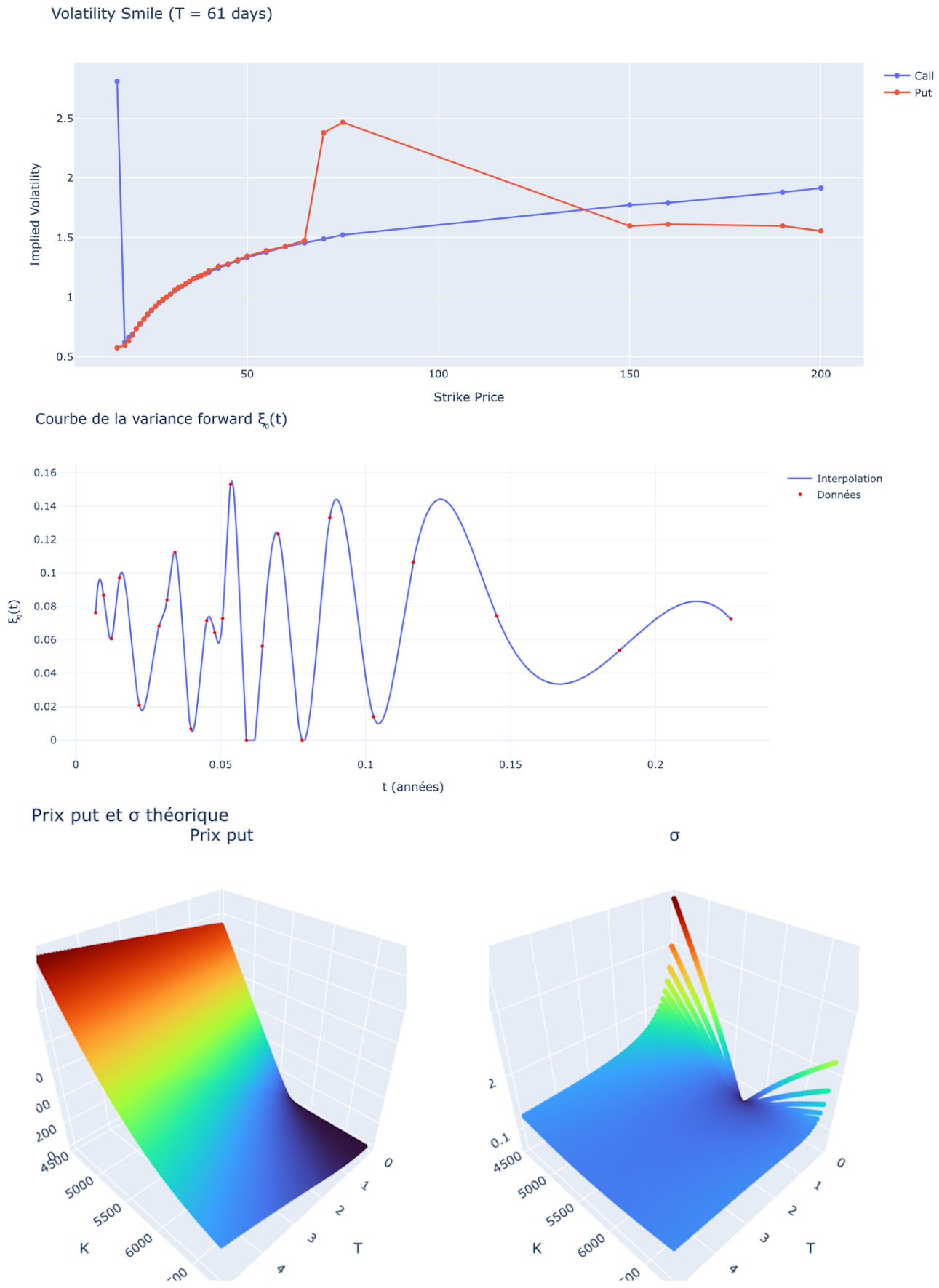

SPX & VIX joint smile calibration

11 Feb 2025 by Tom Gilgenkrantz & Ranim Knaissi

- Joint calibration of SPX & VIX volatility smiles using a Quintic OU stochastic volatility model

- Forward variance term structure ξ₀(t) extracted from market using Carr-Madan formula

- VIX options priced semi-analytically via Gauss-Hermite quadrature exploiting polynomial structure

- Monte Carlo simulation for SPX derivatives with variance reduction (antithetic paths, control variates)

- Optimization via differential evolution to fit real volatility surfaces (CBOE data)

- Analysis of parameter sensitivity and implications of skew/asymmetry in smiles

- Exploration of model extensions: forward calibration, stress testing, real-time arbitrage detection

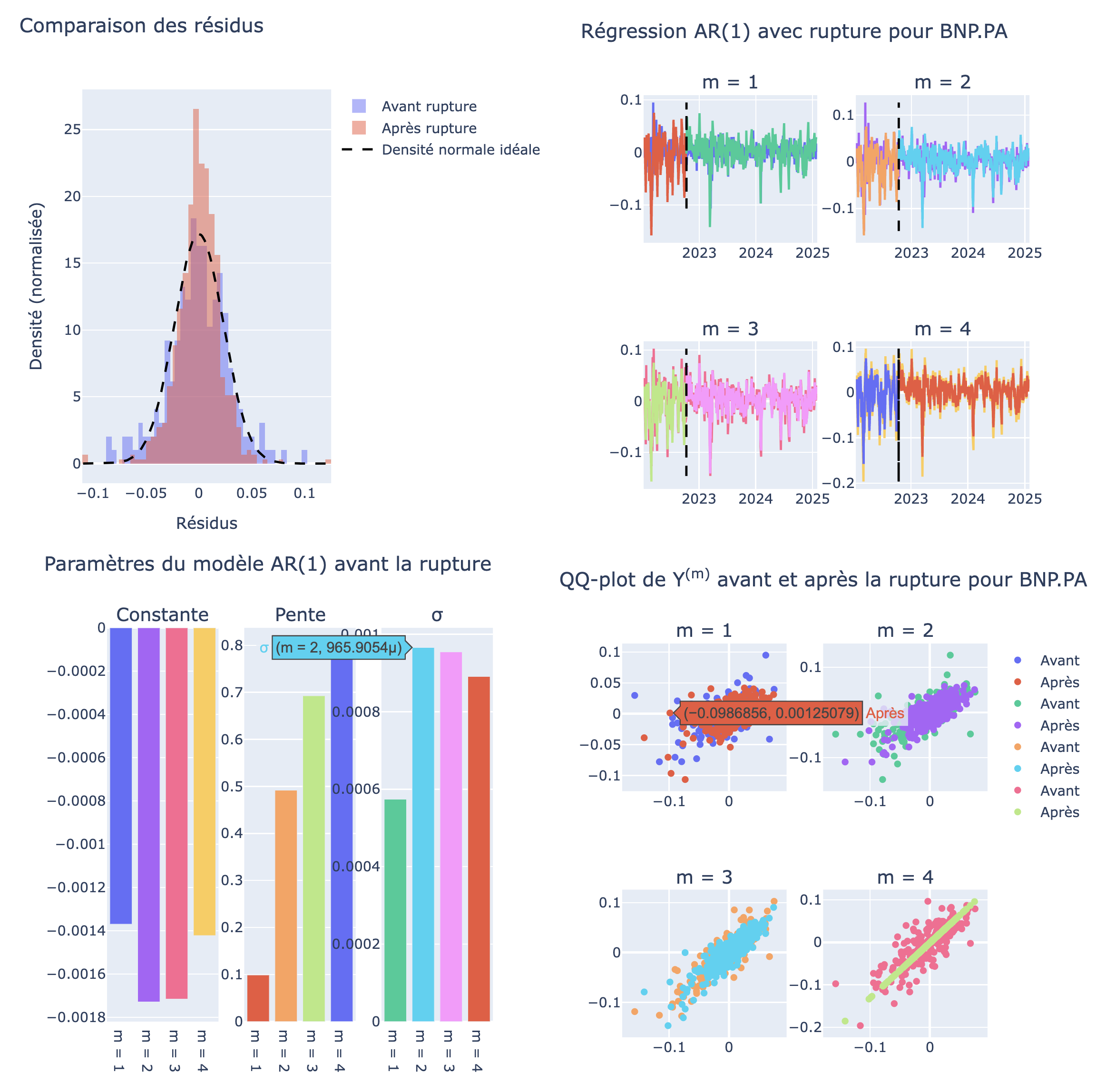

Stocks time series analysis

21 Dec 2024 by Tom Gilgenkrantz & Yassine Boicra

- Data preprocessing and computation of derived series Y(m) for m ∈ {1, 2, 3, 4}

- AR(1) modeling with structural break detection

- Visualization of residuals before and after the break

- Comparison with a normal density & QQ-plots to assess residual normality

- Economic analysis of market regime shifts (SVB crisis, Credit Suisse, ...)

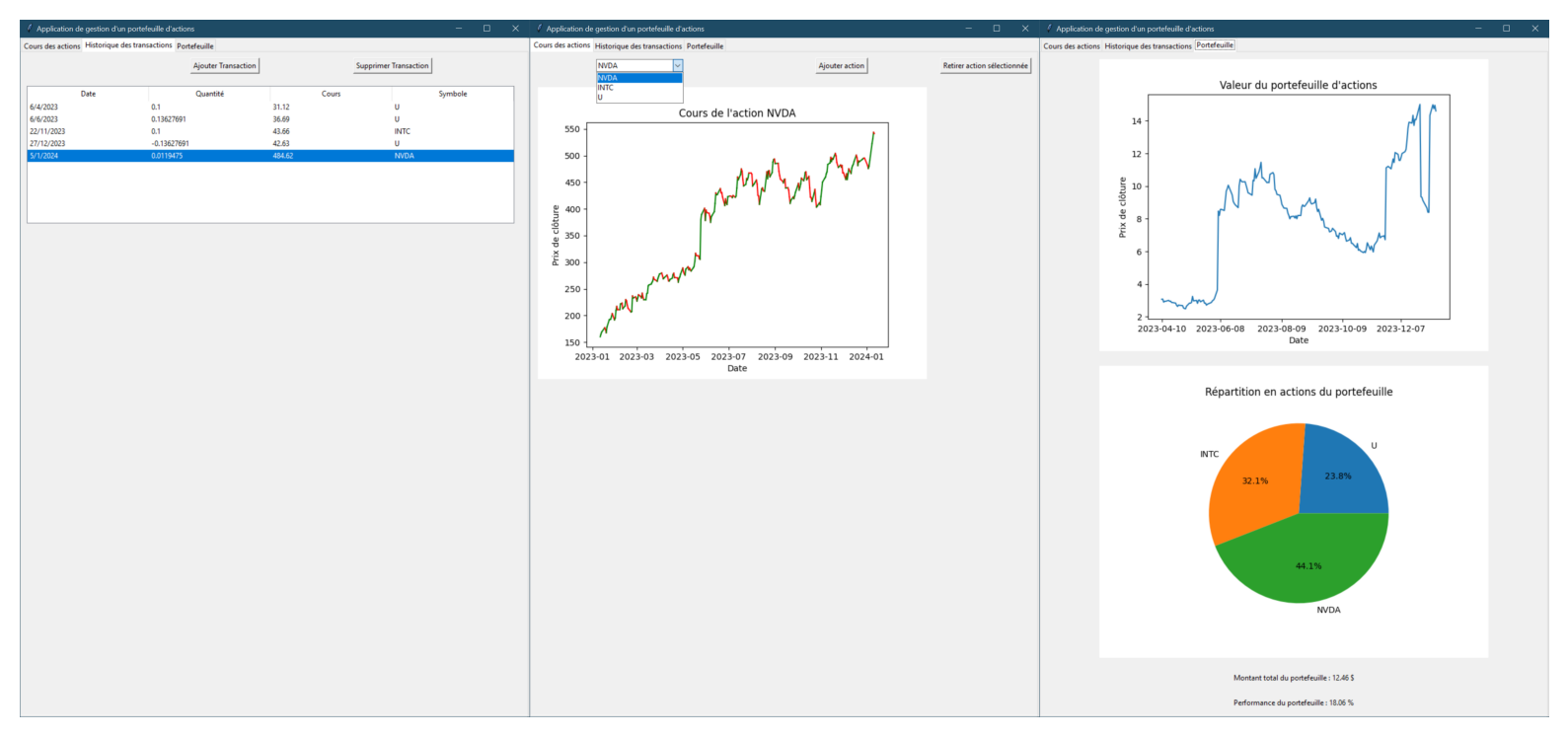

Stock portfolio tracking software

17 Jul 2024 by Tom Gilgenkrantz

- Access to stock prices with Yfinance

- Storing positions in a CSV

- Graphical user interface with Tkinter

- Summary of portfolio performance and diversific'ation